Currencies

CHF 1

AUD 1

Bonds

ZB 2

Metals

Palladium 1

Gold 2

Meat

Lean Hogs -2

Grains

Corn 1

Soybeans 1

Soybean Oil 1

Softs

Milk III 2

Cocoa -1

CT 1

Currencies looking poised to resume uptrend, with AUD showing a nice setup. Bonds and palladium as well. Holding on to the rest of my positions.

Trading is super boring now. Not in the sense of markets, but in sense that I am merely just executing orders. I guess this is good news!

Thursday, May 26, 2011

Wednesday, May 25, 2011

Currencies

CHF 1

Energy

Metals

Gold 2

Meat

Lean Hogs -2

Grains

Corn 1

Soybeans 1

Softs

Milk III 2

Cocoa -1

Sugar -1

CT 1

Got out of stocks for a small loss, getting whipsawed the hell out of me these past few days. But oh well. Currencies exited for a loss as well, and turning long on CHF. Grains looks to be picking up and will be holding on to it. Gold looking fine, but can see slow down in momentum. Not that good a sign, took 1 lot off. Nothing much done for today. Market has been slow and quiet.

CHF 1

Energy

Metals

Gold 2

Meat

Lean Hogs -2

Grains

Corn 1

Soybeans 1

Softs

Milk III 2

Cocoa -1

Sugar -1

CT 1

Got out of stocks for a small loss, getting whipsawed the hell out of me these past few days. But oh well. Currencies exited for a loss as well, and turning long on CHF. Grains looks to be picking up and will be holding on to it. Gold looking fine, but can see slow down in momentum. Not that good a sign, took 1 lot off. Nothing much done for today. Market has been slow and quiet.

Today, I caught myself thinking about how much I must recover in order to turn a profit. That's bad. It leads one to even entertain the thought of doing something stupid and potentially hugely destructive.

Note to self: Focus on the moment. Instead of thinking about making it all back, think about making good trades day after day.

Note to self: Focus on the moment. Instead of thinking about making it all back, think about making good trades day after day.

Tuesday, May 24, 2011

Currencies

EUR -1

GBP -1

Equities

ES -1

TF -1

Energy

Metals

Gold 2

Meat

Lean Hogs -2

Grains

Corn 1

Soybeans 1

Softs

Milk III 2

Cocoa -1

Sugar -1

CT 1

ES showing a small profit, movement shows down side more likely to happen. Added 1 TF short. Holding on to currencies, yesterday's movements should be a small rally.

Grains not showing good short term strength but trend and ML still there, shall hold for another day and see what happens.

Palladium got stopped out yesterday for a small loss. Gold doing nicely and looking to buy breakout of 1528. Was considering silver, but risk too big as it is very volatile. Good to consider risk before initiating position.

Took profits in Feeder Cattle. Very good profits. Holding on to Lean Hogs as down side movement looks to be accelerating.

Sugar stagnant but if down today could set up nice move. CT moving higher and good chance move up could continue.

Best of luck everyone!

EUR -1

GBP -1

Equities

ES -1

TF -1

Energy

Metals

Gold 2

Meat

Lean Hogs -2

Grains

Corn 1

Soybeans 1

Softs

Milk III 2

Cocoa -1

Sugar -1

CT 1

ES showing a small profit, movement shows down side more likely to happen. Added 1 TF short. Holding on to currencies, yesterday's movements should be a small rally.

Grains not showing good short term strength but trend and ML still there, shall hold for another day and see what happens.

Palladium got stopped out yesterday for a small loss. Gold doing nicely and looking to buy breakout of 1528. Was considering silver, but risk too big as it is very volatile. Good to consider risk before initiating position.

Took profits in Feeder Cattle. Very good profits. Holding on to Lean Hogs as down side movement looks to be accelerating.

Sugar stagnant but if down today could set up nice move. CT moving higher and good chance move up could continue.

Best of luck everyone!

Monday, May 23, 2011

Currencies all looks to have turned, with Euro and GBP leading the way. ML solidly down and SL turning. Took a short position in EUR and GBP.

Problem with trend trading is you get a lot of whipsaw, saw that happening earlier in stocks and now in NG. But well, that's the price we pay to trade properly. S&P looks like a good short now with prices below the 50 SMA and ML and SL pointing downwards.

Meats doing extremely well, everything is solidly down. Took 1 lot of feeder cattle and added one to lean hogs.

Trimmed down my positions in grains, holding on to long corn and soybeans. Looks extended and as Chick says, now is seasonally weak period for grains so rather dangerous. Should corn drop tomorrow, needless to say, I am out.

Palladium looks like a good short, with a tight stop at 741. should prices fall today, could set SL off to a long decline which obviously, will have been led by prices.

Sugar looking good, but will not add on to position now, maybe tomorrow. Recent price movements very funny to me.

Currencies

EUR -1

GBP -1

Equities

ES -1

Energy

Metals

Gold 2

Palladium -1

Meat

Lean Hogs -2

Feeder Cattle -1

Grains

Corn 1

Soybeans 1

Softs

Milk III 2

Cocoa -1

Sugar -1

Problem with trend trading is you get a lot of whipsaw, saw that happening earlier in stocks and now in NG. But well, that's the price we pay to trade properly. S&P looks like a good short now with prices below the 50 SMA and ML and SL pointing downwards.

Meats doing extremely well, everything is solidly down. Took 1 lot of feeder cattle and added one to lean hogs.

Trimmed down my positions in grains, holding on to long corn and soybeans. Looks extended and as Chick says, now is seasonally weak period for grains so rather dangerous. Should corn drop tomorrow, needless to say, I am out.

Palladium looks like a good short, with a tight stop at 741. should prices fall today, could set SL off to a long decline which obviously, will have been led by prices.

Sugar looking good, but will not add on to position now, maybe tomorrow. Recent price movements very funny to me.

Currencies

EUR -1

GBP -1

Equities

ES -1

Energy

Metals

Gold 2

Palladium -1

Meat

Lean Hogs -2

Feeder Cattle -1

Grains

Corn 1

Soybeans 1

Softs

Milk III 2

Cocoa -1

Sugar -1

Thursday, May 19, 2011

Equities

ES 2

YM 2

Energy

Nat Gas -2

Metals

Gold Buy 1 at 1501 breakout

Meat

Lean Hogs -1

Feeder Cattle -2

Grains

Corn 1

Rough Rice 2

Soybeans 1

Wheat 1

Soybean Oil 1

Softs

Milk III 3

Cocoa -1

Sugar Limit order at 21.85

Exited currencies as not worthwhile to trade for now. Market is in the middle of changing trends/resuming trend and is a 50-50 shot. Equities poised to rise in my view. If momentum picks up, should see nice follow up today. If not, its a negative sign.

Very bullish on grain complex, and taking quite a big position on its continuation.

I used to put some merit into reversal candlesticks like dojis, but I no longer do. As long as the trend is there, I've seen enough cases of continuations despite candlestick signals.

Buy order for gold at 1501, if it breaks it could resume its up trend. Feeder cattle and milk doing very well, all lines pointing in trend direction and good to hold. Testing out sugar's weakness, if drop tonight will see further down side.

Going to Jakarta for a quick holiday over the weekend, instructions to manage my trades have been left to a colleague.

ES 2

YM 2

Energy

Nat Gas -2

Metals

Gold Buy 1 at 1501 breakout

Meat

Lean Hogs -1

Feeder Cattle -2

Grains

Corn 1

Rough Rice 2

Soybeans 1

Wheat 1

Soybean Oil 1

Softs

Milk III 3

Cocoa -1

Sugar Limit order at 21.85

Exited currencies as not worthwhile to trade for now. Market is in the middle of changing trends/resuming trend and is a 50-50 shot. Equities poised to rise in my view. If momentum picks up, should see nice follow up today. If not, its a negative sign.

Very bullish on grain complex, and taking quite a big position on its continuation.

I used to put some merit into reversal candlesticks like dojis, but I no longer do. As long as the trend is there, I've seen enough cases of continuations despite candlestick signals.

Buy order for gold at 1501, if it breaks it could resume its up trend. Feeder cattle and milk doing very well, all lines pointing in trend direction and good to hold. Testing out sugar's weakness, if drop tonight will see further down side.

Going to Jakarta for a quick holiday over the weekend, instructions to manage my trades have been left to a colleague.

Currencies

CHF 2

NZD 1

Bonds

ZB 0

Equities

ES 2

Energy

Nat Gas -1

Metals

Gold 1

Meat

Lean Hogs -1

Feeder Cattle -2

Grains

Corn 1

Rough Rice 2

Soybeans 1

Wheat 1

Softs

Milk III 3

Cocoa -1

Reversed on my equity shorts and turned long, anticipatory for SL to turn up. Downside for stocks seem supported and would not be surprised for main trend to kick back in. However, am prepared to turn again should the support give way. This is the price I pay to source out trends.

Am out of bonds, as lines turned. For currencies, holding on to CHF short and ready to cut if it does not rise tonight, and NZD longs as well. NZD SL upwards, and will form a bullish divergence should carry on upwards.

Very bullish on grains right now. Big momentum pushed all SL strongly upwards and looking very good to carry on main up trend. Meats as usual, very weak looking. Holding on to my short in feeder cattle and short lean hogs.

CHF 2

NZD 1

Bonds

ZB 0

Equities

ES 2

Energy

Nat Gas -1

Metals

Gold 1

Meat

Lean Hogs -1

Feeder Cattle -2

Grains

Corn 1

Rough Rice 2

Soybeans 1

Wheat 1

Softs

Milk III 3

Cocoa -1

Reversed on my equity shorts and turned long, anticipatory for SL to turn up. Downside for stocks seem supported and would not be surprised for main trend to kick back in. However, am prepared to turn again should the support give way. This is the price I pay to source out trends.

Am out of bonds, as lines turned. For currencies, holding on to CHF short and ready to cut if it does not rise tonight, and NZD longs as well. NZD SL upwards, and will form a bullish divergence should carry on upwards.

Very bullish on grains right now. Big momentum pushed all SL strongly upwards and looking very good to carry on main up trend. Meats as usual, very weak looking. Holding on to my short in feeder cattle and short lean hogs.

Wednesday, May 18, 2011

Current Positions

Currencies

CHF 2

Bonds

ZB 2

Equities

Nasdaq -1

Russell -2

Energy

Nat Gas 2

Metals

Gold 1

Meat

Feeder Cattle -2

Grains

Corn 1

Rough Rice 1

Softs

Milk III 2

Cocoa -1

I reversed my position in Gold and added on to my longs in CHF. Seems like the up trend could resume instead of turning. Same for grains. Nat gas pausing and retraced a bit but I believe there is still further upside.

Currencies

CHF 2

Bonds

ZB 2

Equities

Nasdaq -1

Russell -2

Energy

Nat Gas 2

Metals

Gold 1

Meat

Feeder Cattle -2

Grains

Corn 1

Rough Rice 1

Softs

Milk III 2

Cocoa -1

I reversed my position in Gold and added on to my longs in CHF. Seems like the up trend could resume instead of turning. Same for grains. Nat gas pausing and retraced a bit but I believe there is still further upside.

Tuesday, May 17, 2011

Returns so far

I started trading my main account in August Saxobank. In November, I decided to move the account to Interactive Brokers and only resumed trading in December, late December. At my time with Saxo, I made 126k USD. At IB, I ran the account up by 93k USD only to give it all back to where I currently am, down 20k USD. So all in all, I made 106k USD, giving me a return of around 20% after deducting fees. Not bad for 10 months worth, no?

What an awful feeling it is, climbing up from a massive drawdown. It is easy to lose control of our very own nature to want to get it all back as soon as possible. Such a reaction can only lead to impulsive gambling and irrational position sizing which in turn leads to a blowout. The only way out of this is to discipline ourselves to push away these impulses and hold ourselves in check. Reduce position sizes and trade clear signals.

For today, I'm holding on to my CAD shorts and added NZD. As CHF showed a dip buying opportunity. I went long CHF as a hedge. Either way I'm poised to double up or exit my CHF when things get clearer tomorrow.

Stocks did beautifully, although my ES hit my stops for a small loss, TF showed me a handsome profit, and I intend to hold onto it as it shows downside potential still. NQ gave a short signal and a breakdown of it's range. Added 1 NQ short.

Gold poised to head lower unless it heads up today, warranting an anticipatory short.

Natural Gas showed some profits and movements yesterday was good. See further upside and added on to my longs.

Cotton reacted against me but trends still solidly down and see a rally as temporary. Holding on to shorts.

Soybeans looks like it's on the verge of breaking, if today closes around here or lower, good sign. Will add on. However if today moves higher, will exit with a small loss.

Wheat looks like it will rally. SL definitely turning up today, unless major move happens. Exited wheat at near breakeven.

For today, I'm holding on to my CAD shorts and added NZD. As CHF showed a dip buying opportunity. I went long CHF as a hedge. Either way I'm poised to double up or exit my CHF when things get clearer tomorrow.

Stocks did beautifully, although my ES hit my stops for a small loss, TF showed me a handsome profit, and I intend to hold onto it as it shows downside potential still. NQ gave a short signal and a breakdown of it's range. Added 1 NQ short.

Gold poised to head lower unless it heads up today, warranting an anticipatory short.

Natural Gas showed some profits and movements yesterday was good. See further upside and added on to my longs.

Cotton reacted against me but trends still solidly down and see a rally as temporary. Holding on to shorts.

Soybeans looks like it's on the verge of breaking, if today closes around here or lower, good sign. Will add on. However if today moves higher, will exit with a small loss.

Wheat looks like it will rally. SL definitely turning up today, unless major move happens. Exited wheat at near breakeven.

Monday, May 16, 2011

For trading today, I'm short stocks, CAD, wheat, cocoa and corn. Market currently very volatile and is in the midst of a probable trend change. Very hard to trade now and am only doing 1 lots to minimize damage until trends are clear again. I have been reflecting on my trades and thank god SMR has a Step Mode where I can go back to any point in time and start paper trading from there. I feel sharper and more confident now. Which is always a good sign for traders, I guess.

Russell 2000

Trend is up but anticipating a change, ML solidly down with SL first turn. Prices have to stay below 835.28 for SL to sustain. If SL breaks 835, easy out decision.

Wheat

Trend ML and SL solidly down. Prices need to move up 22 points in order to push up SL. Very hard. No stops placed will review tomorrow.

Russell 2000

Trend is up but anticipating a change, ML solidly down with SL first turn. Prices have to stay below 835.28 for SL to sustain. If SL breaks 835, easy out decision.

Wheat

Trend ML and SL solidly down. Prices need to move up 22 points in order to push up SL. Very hard. No stops placed will review tomorrow.

Position Sizing

I've been pondering a lot on automated systems and its benefits to me. Upon reflection, the draw-down that I am currently in now comes as no surprise, every trading methodology has periods of poor performance. What was shocking though, was the size of my draw down.

Leverage like they say, is a double edged sword. In order to lower the size of future draw downs, I need a strict but robust risk management system. A position sizing method to enlarge profits and minimize losses. Straight off the top of my head is the simplest trade larger when you're earning and trade smaller when you're losing. Which is almost the opposite of what I did the past 2 months.

Back to the topic of automated systems, my trading methodology though currently discretionary has all the potential to be automated. Rigid rules and programmable discretionary decisions. However, I know nuts about programming and therefore, need to find a suitable partner to aid me.

Hopefully I will be able to find him/her soon.

Leverage like they say, is a double edged sword. In order to lower the size of future draw downs, I need a strict but robust risk management system. A position sizing method to enlarge profits and minimize losses. Straight off the top of my head is the simplest trade larger when you're earning and trade smaller when you're losing. Which is almost the opposite of what I did the past 2 months.

Back to the topic of automated systems, my trading methodology though currently discretionary has all the potential to be automated. Rigid rules and programmable discretionary decisions. However, I know nuts about programming and therefore, need to find a suitable partner to aid me.

Hopefully I will be able to find him/her soon.

Sunday, May 15, 2011

Saturday, May 14, 2011

Re-reading Reminiscences of a Stock Operator, I realize one big difference between my trading now and when I was profitable.

I was always able to look at my quotes 1 time a day and sleep soundly at night when I was making money.

A key aspect of my trading that I held highly in regard was to trade small positions. Positions so small that I do not even care about the daily P/L fluctuations. Now, however, I go through roller coasters whenever I have a position on.

Note to self: Reduce position sizing.

PS: To those who think small positions are a waste of time, note that I was able to return >30% of my portfolio by trading 1 lots, in a month!

I was always able to look at my quotes 1 time a day and sleep soundly at night when I was making money.

A key aspect of my trading that I held highly in regard was to trade small positions. Positions so small that I do not even care about the daily P/L fluctuations. Now, however, I go through roller coasters whenever I have a position on.

Note to self: Reduce position sizing.

PS: To those who think small positions are a waste of time, note that I was able to return >30% of my portfolio by trading 1 lots, in a month!

Thursday, May 12, 2011

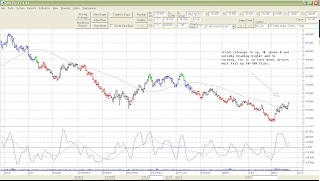

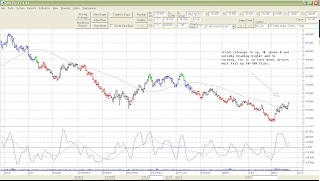

Mini Russell JUN11

Weekly

Prices have been making higher highs, but SL went the opposite way creating quite a massive divergence. ML though above 0, is sharply down. Also, in order for SL to turn up, prices have to close above 897.12 this week, which is nearly impossible.

Daily

Trend up, ML above 0 and pointing slightly upwards. SL turned 2 days ago but in precarious position to turn today. With the turning point at 830.43, chances are high that it will start turning down. As Chick mentioned, it will be a very bearish pattern should the SL turn down now, and could lead to a prolonged down swing.

It would be safer to wait for SL to turn before initiating a position, but I like to anticipate and thus, went short here. I will be looking to add on to my position when SL really turns.

Weekly

Prices have been making higher highs, but SL went the opposite way creating quite a massive divergence. ML though above 0, is sharply down. Also, in order for SL to turn up, prices have to close above 897.12 this week, which is nearly impossible.

Daily

Trend up, ML above 0 and pointing slightly upwards. SL turned 2 days ago but in precarious position to turn today. With the turning point at 830.43, chances are high that it will start turning down. As Chick mentioned, it will be a very bearish pattern should the SL turn down now, and could lead to a prolonged down swing.

It would be safer to wait for SL to turn before initiating a position, but I like to anticipate and thus, went short here. I will be looking to add on to my position when SL really turns.

XXX,

Difficult markets recently since so volatile. As always use following at your own risk, but as I see it looks like major trends in stocks, currencies (except yen and metals all turing down. Feel could be on verge of major down moves in all these. If SL's in stock indexes turn down in next day or two would set up potentially very bearish patterns and type that could lead to major trend change down and lead to sustained down moves. Same patterns exist in all currencies (except yen) and could produce same thing as in stocks (trend change to downside with following sustained down moves). Safer to wait for turn down in SL's but at moment am short (in anticipation of trend changes) Russell 2000 and NDX. Also bought some VIX futures this AM. If stocks do turn trends down, as feel they will, could see VIX move up over 30.00 and maybe even up to 40.00 level. Since currently trading in 17.00 area (May) and 18.50 area (June) and each point $1K have potential 12K to 20K move per contract in VIX.

In currencies am against trend short C Dollar and long US dollar. Should trends turn down in currencies would have what call best combination for good sized sustained moves since have had long lasting very bearish COT situation (commercials have been heavily short for long time) and so all need is for trends to turn down. Close to getting third lower high in SL in C Dollar at same time ML on solid down cycle.

Grains a little tougher call since have such potentially bullish supply/demand situation and also potentially very bullish weather situation.

Cocoa has potentially very negative pattern.

At moment some of these markets oversold but this can continue for week or more.

At moment ML in silver on super solid down cycle and very difficult to sustain any up move when this case, although moves so big there even a two, three day counter ML cycle up move can be sizable (witness six cent rally of several days ago). However, see decent chance will see July Silver trade below 25.00 within next two, three weeks and maybe even down to 20.00.

Copper situation very bearish since have had "best combination" for good sized, sustained down move there since commercials have been, and still are, heavily net short and recently went concurrent to downside and still is.

So see anticipation shorts in stock indexes and currencies as worthwhile spec. And see risk/reward on long VIX as excellent (this just another way to be short stocks but with much more potential.

If downside right on these "should not" see prices above highs of past couple days so can use those levels as give up points and thes e not too far away and since downside potential very big if do turn trends down all these have quite good risk/reward situations.

Key will be whether can turn SL's down next few days, believe will but doesn't happen til it happens although am willing to bet on anticipation they will (SL's turn down).

Chick

The quote above was sent by my teacher, Chick Goslin. Read at your own discretion.

The past 2 months have been very bad for me, both in terms of equity swings, and a seemingly lost mind. In terms of money, the losses I made has been the worst of my life. Naturally, it affected my mind very much, causing all sorts of internal turmoil. It started me thinking, have I made money based on pure luck? Did I manage to make money just because I was a bull in a bullish market? Or did my 6 years of experience actually taught me something. Up till now, I am still figuring. Needless to say, there is only one way to find out. I must clear my mind of all doubts and carry on through with my methods.

I used to think I was flexible, that I could reverse my positions on an inkling. Reading the email above, I realize that I was desperately clinging on to a trend that might have turned. Whether it really turns or not, is another question. But definitely, the signs are there that shows either I should be starting to test the downside, OR, stay out of the market. This is no time to be stubborn.

I have my eyes open now, and will be posting a detailed analysis today of the markets.

Tuesday, May 10, 2011

CAD

Holding on to my positions for a while before I start adding on

Stop moved to 1.0340

Risk at 174 ticks

$: 1740 USD

YM

Added to my positions at 12709. SL will be going up strongly

unless there's a big reaction.

Stops moved to 12570

Risk at 600 points

$: 3000 USD

TF

Added slightly, tick size rather big.

Stop at 839

Risk: 24 points

$: 300 USD

CT

DIP

Trend flat, SL turning up after forming bullish divergences

and ML flat to pointing up

Trying to buy limit at 1.2560, stop at 1.2100

OJ

Momentum

Trend flat, ML flat, SL Pointing up

Buy market

Stop at 166.25

+6.8k

Positions carried from yesterday are all in the money. Forward looking, I expect equities and currencies to march much further upwards. However, I am not able to anticipate the future and can only trade day by day according to what prices tell me. So far, they show me that the path of least resistance is upwards.

I will add on my positions upon further movement, probably tomorrow or the day after.

Holding on to my positions for a while before I start adding on

Stop moved to 1.0340

Risk at 174 ticks

$: 1740 USD

YM

Added to my positions at 12709. SL will be going up strongly

unless there's a big reaction.

Stops moved to 12570

Risk at 600 points

$: 3000 USD

TF

Added slightly, tick size rather big.

Stop at 839

Risk: 24 points

$: 300 USD

CT

DIP

Trend flat, SL turning up after forming bullish divergences

and ML flat to pointing up

Trying to buy limit at 1.2560, stop at 1.2100

OJ

Momentum

Trend flat, ML flat, SL Pointing up

Buy market

Stop at 166.25

+6.8k

Positions carried from yesterday are all in the money. Forward looking, I expect equities and currencies to march much further upwards. However, I am not able to anticipate the future and can only trade day by day according to what prices tell me. So far, they show me that the path of least resistance is upwards.

I will add on my positions upon further movement, probably tomorrow or the day after.

Currencies

GBP

Dip Buying

Trend up but not concurrent. SL at lows.

If close up today SL should turn.

Look to buy break out of 1.6440

Stop at 1.6260

Risk : 180

CAD

Dip

Trend solidly up but not concurrent, SL extreme low.

Buying the dip with a tight stop.

Risk: 77 ticks

Order to buy at 1.0405 on scale up basis.

Will add on more at 1.0450

Equities

YM

Dip

Trend up, concurrent with SL most likely turning up tonight.

If doesn't turn out tomorrow. Simple trade.

Stop at 12460

Risk: 190

Metals

GC

Dip

Trend up, crosscurrent with SL most likely turning up tonight.

Buy break of 1514

Stop at 1500

Risk: 140

% State: -28.8%

GBP

Dip Buying

Trend up but not concurrent. SL at lows.

If close up today SL should turn.

Look to buy break out of 1.6440

Stop at 1.6260

Risk : 180

CAD

Dip

Trend solidly up but not concurrent, SL extreme low.

Buying the dip with a tight stop.

Risk: 77 ticks

Order to buy at 1.0405 on scale up basis.

Will add on more at 1.0450

Equities

YM

Dip

Trend up, concurrent with SL most likely turning up tonight.

If doesn't turn out tomorrow. Simple trade.

Stop at 12460

Risk: 190

Metals

GC

Dip

Trend up, crosscurrent with SL most likely turning up tonight.

Buy break of 1514

Stop at 1500

Risk: 140

% State: -28.8%

Subscribe to:

Posts (Atom)